OVERVIEW

The Ardonagh Group is the UK’s largest independent insurance broker with a global reach. Ardonagh Group is a network of over 100 office locations and a workforce of over 6,000 people.

Formed in 2017 and following a series of acquisitions in 2018, Ardonagh today brings together best-in-class brands including Autonet, Bishopsgate, Carole Nash, Geo Underwriting, Price Forbes, Swinton, Towergate and URIS. Ardonagh’s understanding of the communities it serve, together with its scale and breadth, allows them to work with their insurer partners to deliver solutions that meet their customer needs.

Consistency across 100 locations

In order to achieve consistency in risk management and compliance across its 100 office locations Ardonagh Group chose the Decision Focus GRC solution. The solution is applied across the whole Ardonagh Group with over 350 users across all parts of the business. Risk and compliance activities are managed and co-ordinated using the Decision Focus GRC solution which aligns the overarching policies and framework - and provides consistency in the assessment and management of risk and compliance across the group.

Deploying Decision Focus GRC across all functions and entities within the Group ensures that Ardonagh can meet its regulatory requirements with confidence.

“Both our risk and compliance advisory as well as our assurance teams use Decision Focus to great effect. Decision Focus tracks our performance against the policies and standards we have put in place. Control effectiveness assessments and testing outcomes drive the whole process. That gives us objective confidence of where things are fine, and where we can improve.”

Glenn Morrison, Group Risk Director Ardonagh Group

An integrated approach to risk and compliance

The solution was configured to reflect the precise needs of the integrated risk and compliance framework at Ardonagh. The framework combines the needs of all assurance functions - be it the central risk and compliance team, internal audit tracking of actions, IT monitoring, detailed IT control effectiveness, or the Finance team who wants assurance over financial controls.

The integrated approach within Decision Focus gives multiple additional benefits, including evidencing compliance with the SMCR regime, as all risks, controls, actions and corporate policies are reportable by relevant senior manager.

Decision Focus also supports the distribution of a consistent approach to all the business units in all of the locations.

Benefits for Ardonagh Group

Consistent assessment of risks, controls and business standards

The standardised approach in Decision Focus enables reliable assessment of priorities across the Ardonagh Group and provides confidence that risk, control and business standards are monitored correctly. This provides confidence in

the MI (Management Information) when monitoring the landscapes for the Risk, Control and Business Standards across the business. The central team manages consistency by also using risk and control libraries for central maintenance.

Futureproof, flexible technology evolves with new business requirements

The central Risk and Compliance team is able to configure the solution themselves. Decision Focus supports the flexibility and agility which is central to a global insurance company as the framework continues to evolve.

Integrated framework

Decision Focus does not only provides an integrated risk and compliance framework at Ardonagh Group, but also brings together the wider aspects of the risk framework like risks which might pose a potential conflict of interest,

risks which have a conduct risk consequences, and risks which have a potential cyber risk.

-1.jpg?width=600&name=Risk%20Landscape%20(2)-1.jpg)

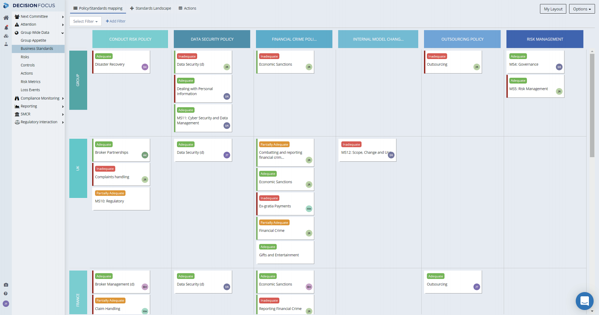

Risk Landscape (example)

Business Standards (example)

One-stop-shop for action tracking

Housing all actions from 2nd and 3rd line in one place (Risk Committee actions, Internal Audit actions, Compliance monitoring actions) provides the 1st line with one repository of actions to update. This gives a more intuitive and easier approach to managing action closure.

Highlights

- Integrate assurance across all three lines of defence

- Automated SMCR approach enables more streamlined and efficient reporting process

- Combined action tracking in one place saves hours per action owner

- All business areas and classes of risk are covered within Decision Focus

- One of the few systems to span all entities within the Ardonagh Group.