If Benjamin Franklin were catapulted into the Insurance Sector of 2021 and given the opportunity to reflect on the contents of the 1789 letter he wrote to Jean-Baptiste Le Roy, he might add two additional certainties of life:

“Nothing can be certain but death, taxes, change and regulation.”

UK Insurance Regulation

According to the Association of British Insurers1 (ABI), regulation can act as an enabler of the outcomes that insurers want to achieve rather than something to be avoided at all costs. The examples of how the private motor insurance market lobbied the competition regulator to address the problem of credit hire or the establishment of the regulatory framework around Flood Re are testimony to positive benefits that regulation can deliver.

This is not to say that the regulatory frameworks that the industry gets from the government are always perfect. They also impose some strict requirements when it comes to submitting the raw or summary data that is required from the various regulatory authorities.

The last 8 years have been a tidal wave of regulations and the surge of change continues as regulation expands into new areas such as climate risk and insurtech supervision. Add into the mix statutory reporting requirements covering both financial and non-financial information and the volume of returns companies need to make seems to grow exponentially.

It is of little surprise that many firms are struggling to keep up-to-date with the status of submissions they need to make and there is a tangible risk that reporting obligations will not be met, even with the best of intentions. The ramifications of making incorrect statements or even missing returns can be serious. Brand reputation can quickly be destroyed and for those individuals falling within the Senior Managers Regime, criminal charges involving financial or even custodial penalties can be life-changing.

The regulator’s view

In the UK, regulation of insurers and reinsurers is undertaken by the Prudential Regulation Authority (PRA) for prudential purposes and the Financial Conduct Authority (FCA) for conduct purposes. In addition, Lloyds Managing Agents are regulated by Lloyd’s itself and Lloyd’s brokers and members’ agents are regulated by the FCA and Lloyd’s.

The reliability of reporting undermines strong regulatory governance and in a ‘Dear CEO’ letter to Chief Executive Officers of PRA-regulated banks and building societies published in October 2019 the PRA clarified that they expect firms to:

’Submit complete, timely and accurate regulatory returns’.

The expectation from the two Executive Directors signing the letter, Sarah Breeden & David Bailey was explicit. Firms should be able to “demonstrate how the design and operation of the governance, controls and other processes deliver regulatory reporting of appropriate quality.”

So how do you prepare for the requirements set out in this letter?

Working practices today

Many organisations are still approaching regulatory reporting with manual methods and disparate systems throughout some, if not all, of the process. The compliance function at one financial services firm I spoke with recently were trying to track 100s of returns using a combination of SharePoint, Excel trackers and Outlook reminders.

They are not alone. This is the reality for many organisations who are typically faced with multiple different systems that do not talk to one another and different data feeds in varied formats with spreadsheets and macros thrown in for good measure. This is not necessarily a criticism – it is no mean feat to be able to extract, amalgamate and consolidate data from core systems, whose primary purpose is not to support regulatory reporting.

Another common issue is the lack of oversight on ‘below the radar’, locally-made returns. Each year a return may be submitted diligently – on time to the required quality - but without the return being visible more widely a lottery win or a cruel twist of fate could mean that next year’s return will simply fall between the cracks.

How can Decision Focus help?

We believe that technology-enabled automation and data management are critical elements of an agile, robust reporting function that will enable organisations to be more proactive as new requirements arise.

Submitting ‘complete, timely’ returns

A typical starting point on a project to improve regulatory reporting is to set up a central repository for all regulatory and statutory returns replacing manual reporting processes. This provides a ‘single lens’ through which to view regulatory reporting and supports the compliance function in obtaining required oversight. Filtered views from this single repository can then be provided to areas such as Tax or Finance where ‘reporting champions’ can manage their own reporting requirements. Return owners can also receive timely reminders when returns they are responsible for, are approaching the due date.

Do not get me wrong, there is a significant investment of time required to create a set of reusable reporting templates describing the frequency of each return, the legal entity(s) impacted, the external or internal recipient, the person responsible etc. but this activity lays the foundation to reap future rewards.

The technology-enabled automation means that each return for each legal entity whether it is monthly or annually exists as an individual record in the system. This transparency removes the opaqueness that pervades many regulatory reporting frameworks and lays the foundation for demonstrating to the regulator that the design and operation of the control framework helps to manage the submission of timely regulatory reporting.

Achieving ‘accurate’ quality returns

Achieving the ‘reporting of appropriate quality’ as specified in the Dear CEO letter is an area that also challenges many firms. This is due in part to there being so many steps in the middle of the ‘Record to Report Cycle’ (R2R). To go from systems of record to submitting a report involves several steps of data collection and validation where people, process and technology can become blockers to giving leadership the confidence they need to sign off. The solution we have established to this challenge is beautifully simple. The definition of each template return can include a set of template tasks representing the main preparation and approval activities involved in making a submission. When the individual returns are created, individual tasks for each reporting period are copied providing a system of record to track the activities. This approach fits into our company-wide mantra about keeping things simple.

“Doing the right things right the first time and then applying efficiency to ensure we are doing the right things efficiently and faster”.

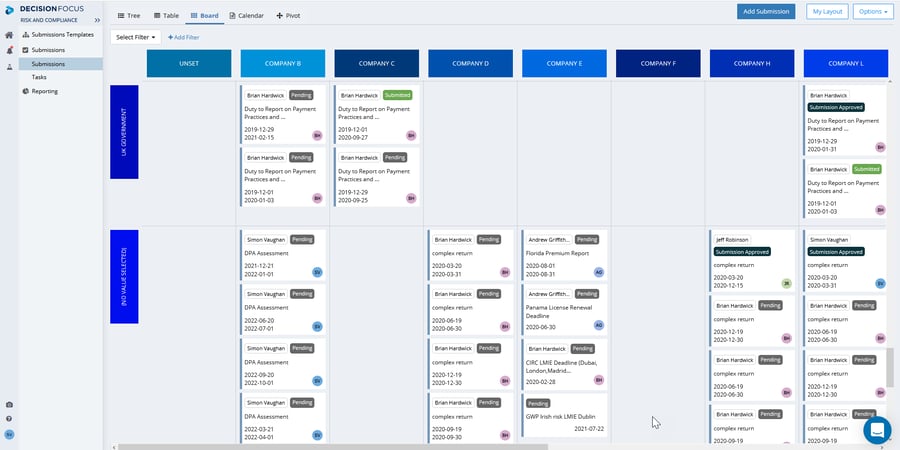

Example 1. Returns by legal entity and recipient

Example 1. Returns by legal entity and recipient

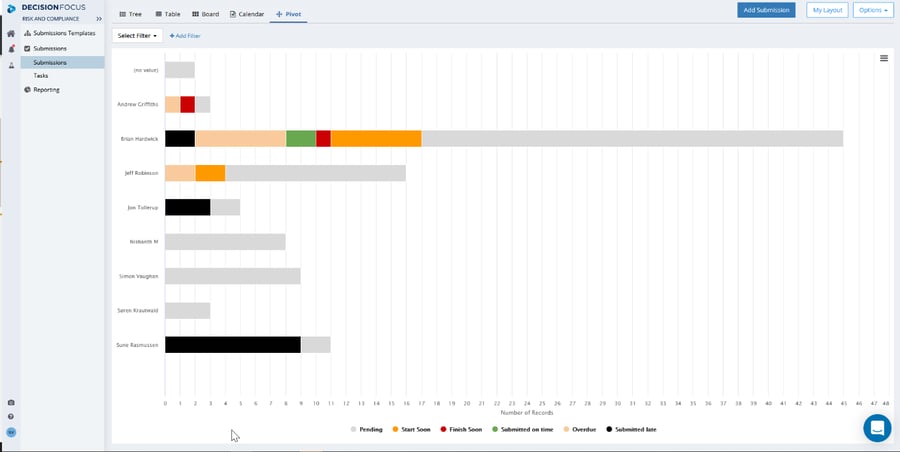

Example 2. Return status by owner

Example 2. Return status by owner

The recent regulatory actions send a clear message i.e. that insurers can anticipate higher levels of accountability and enforcement moving forward and that regulators are not easing up on their expectations.

If you would like to discuss your firm’s response to this Dear CEO letter or to learn more about how we are helping firms deal with the challenge of delivering complete, timely and accurate regulatory reporting please get in touch.